The Governance Trap

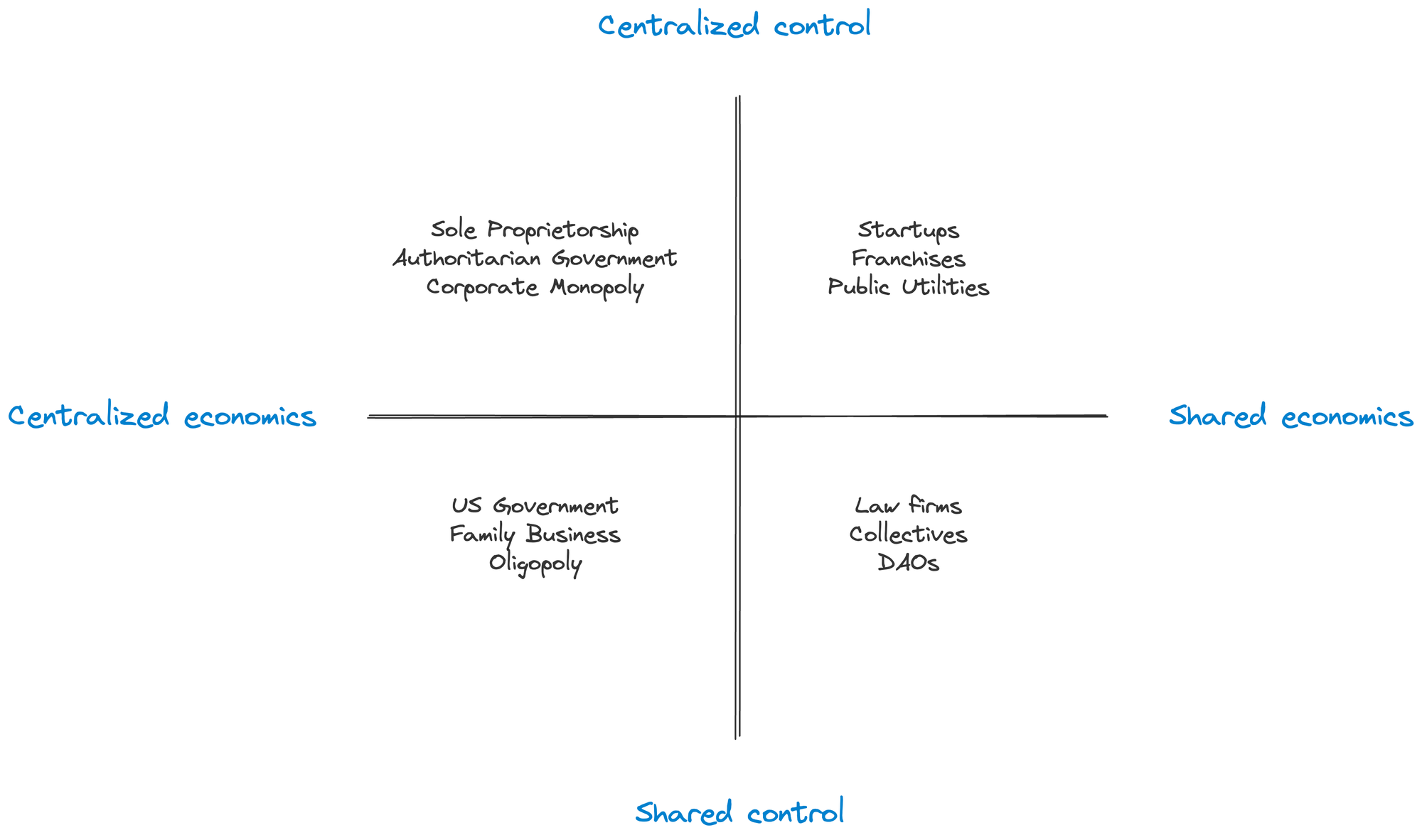

In a recent interview, Ben Horowitz outlines a16z's unique approach to governance. He calls it "shared economics with centralized control."

Ben explains that most venture capital firms operate on a model of shared economics and shared control, similar to law firms. Shared control, he argues, complicates decision-making and hinders structural changes needed for growth. For example, the organizational structure suitable for a 50-person company won't work for a 500-person company. High growth firms need centralized control to avoid politicking and delays, even if it leads to internal resistance.

Firms with centralized control adapt quickly to market changes and make big bets. More importantly, it creates a unified culture and enables the leadership team to make tough decisions that optimize organizational effectiveness.

A collective delusion

We can apply Ben's frameworks to other organizations:

"Monopolists lie to protect themselves. They know that bragging about their great monopoly invites being audited, scrutinized, and attacked. Since they very much want their monopoly profits to continue unmolested, they tend to do whatever they can to conceal their monopoly – usually by exaggerating the power of their (nonexistent) competition."

Peter Thiel, Zero to One

Many firms fall victim to mass psychosis. They misclassify themselves — either intentionally or unwittingly — and start to believe the lies they tell.

Monopolies that disguise their market power invest in distractions, weakening their competitive position over time. Small firms that want to appear unique limit their growth and deter investment.

This problem is particularly acute in DAOs, which emphasize shared control to avoid regulatory scrutiny. By distributing decision-making among token holders, DAOs can argue they are not promising profits primarily through the work of others.

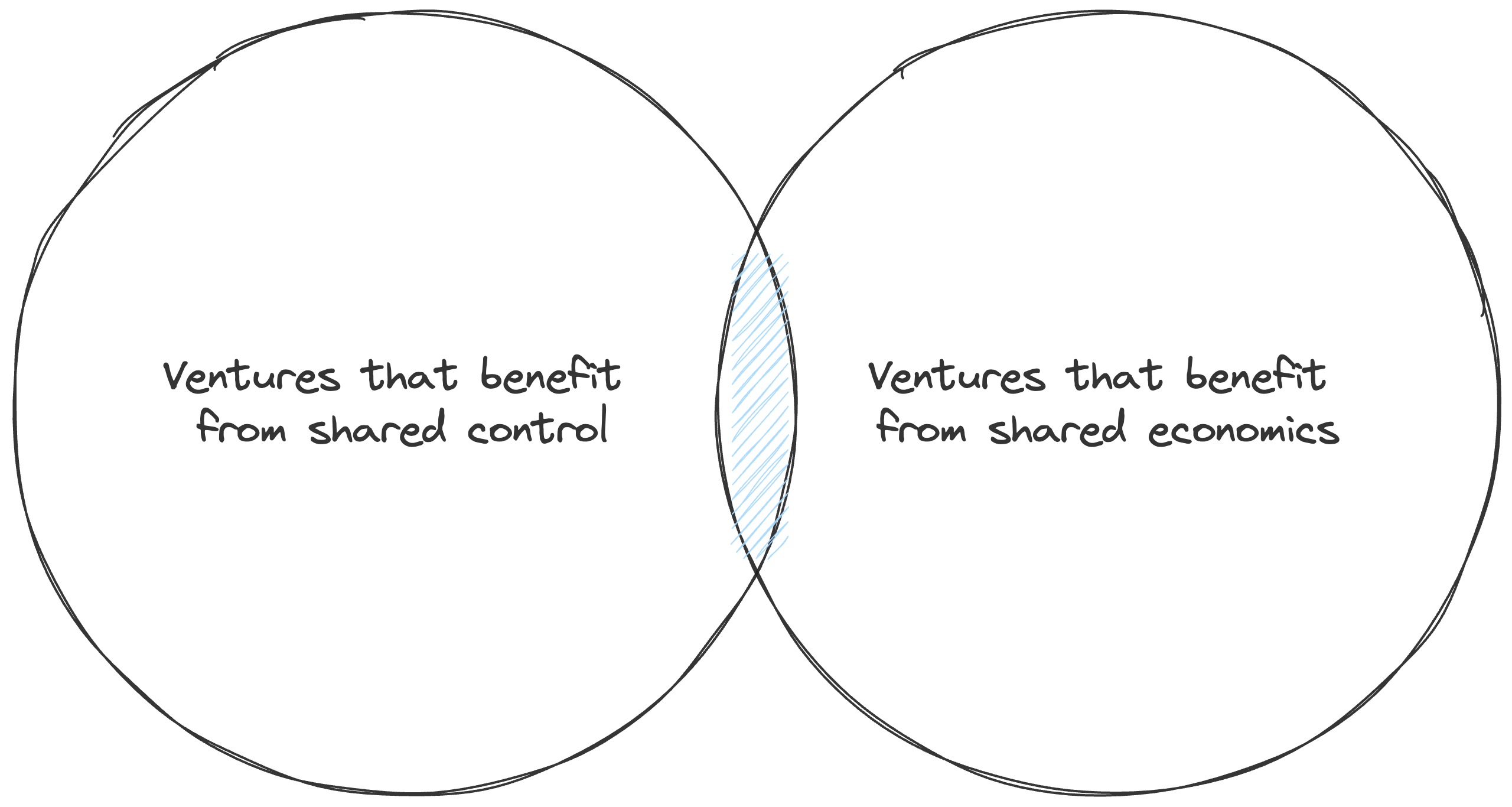

But this emphasis on shared control handicaps the economic benefits of DAOs. Public blockchains offer 10x improvements in transparency and global access compared to traditional equity structures; an opportunity that DAOs are uniquely well suited to capture. Requiring firms to handicap themselves to benefit from these advancements is bizarre, since firms that can thrive with both shared control and economics are exceedingly rare.

DAOs have the potential to increase the GDP of the internet and democratize economic gains more broadly than traditional organizational structures. However, this potential is stifled if DAOs are forced to surrender control to exist in today's regulatory landscape.