On cryptocurrency

I sometimes get asked what I think of cryptocurrency.

I think that cryptocurrencies represent a new asset class that is based on the large scale coordination of computer networks to secure financial transactions. They allow the holder to exchange funds without the need for a central intermediary like a bank or payment processor. Instead, the transactions are recorded by the users of the network who perform this service in exchange for transaction fees.

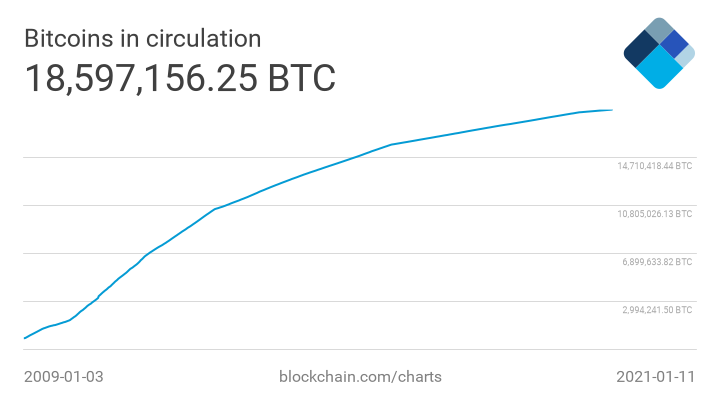

Recently, there has been a growing interest in cryptocurrencies due to their decentralized nature and lack of government influence. Unlike "fiat" currency (e.g. USD), cryptocurrencies often have a fixed supply (you can't just print more). This means that they are deflationary -- their value increases over time due to growing demand. Bitcoin is the most well-known cryptocurrency and has a fixed supply of 21 million. "Bitcoin" is the name of the network that facilitates transactions of "bitcoins" (lowercase b). New bitcoins (BTC) are created on a fixed schedule that has been ongoing since the network was first created in 2009. Here is what the supply curve of Bitcoin looks like:

The current market cap of Bitcoin is about $650B. There are ~18,600,000 bitcoins in circulation, and the remaining 2.4 million will be created over the next 100 years or so based on a fixed schedule.

The best analogy that I've found for Bitcoin is a naturally occurring resource like gold. People buy it because they want to own a piece of a scarce resource that is uncorrelated with other assets in their portfolio like cash or equities. The value of Bitcoin increases because the supply line will asymptotically approach 21,000,000 over time.

Dividing the market cap by the total number of coins in circulation gives you the value of one bitcoin. These prices move up or down based on the market -- how much currency people are willing to exchange to buy cryptocurrency. Here is the chart of BTC versus USD over the last six years:

As you can see, the price of a single bitcoin (on the left axis) has increased significantly. This is why people are interested in investing in Bitcoin. Since there is a fixed supply, the only way for a traditional investor to get bitcoin is to buy it from someone else. As more people become interested in owning bitcoin, this drives up the price.

Bitcoin, and cryptocurrencies in general, have been characterized by periods of speculation that attract the attention of investors. Although the underlying mechanism that powers the Bitcoin network has remained relatively unchanged, there are periods when the price is driven up by increasing demand. We are in one of those periods now. As Bitcoin becomes easier to access, a larger number of people are choosing to exchange fiat currency (USD) to purchase Bitcoin and other cryptocurrencies. Right now, most of the price action is caused by large institutional investors and businesses adding Bitcoin to their balance sheets.

There are other cryptocurrencies too. Cryptocurrencies represent a way for groups of people to experiment with different monetary systems without needing to form their own government to mint a currency. Bitcoin was the first widely accepted cryptocurrency and is currently has the largest market capitalization. The second-largest cryptocurrency by market cap is called Ethereum.

Ethereum is similar in that it allows people to exchange value without needing a centralized intermediary. The main feature of Ethereum is that you can "program" your money. For example, imagine you are waiting for a deal to close and you need to hold money in escrow. Instead of using a 3rd party, Ethereum allows you to send this money based on an "if-then" statement (e.g. if you send me the money, then I will transfer you the deed to this property). All of this is handled by computers instead of humans. This reduces the need for intermediaries and opens up new types of financial instruments. Most of our financial system is based on complicated "if-then" statements -- Ethereum is an attempt to automate these processes. The unit of value exchanged on the Ethereum network is called "ether" (ETH).

Here is the chart of ETH versus USD over the last five years:

Both Ethereum and Bitcoin have gained widespread adoption throughout the world. Neither are controlled by a central government.

In order to invest in cryptocurrencies like Bitcoin or Ethereum, you need to find someone who is willing to sell some to you. This is handled through "exchanges" -- markets where buyers and sellers can exchange USD for the cryptocurrency of their choice. Two of the most popular exchanges in the United States are Coinbase and Gemini. These are American companies that operate under financial regulations and allow users to buy and sell cryptocurrency in a safe way.

Opportunity

As with any investment, there is risk. Cryptocurrencies are a new technology and may prove to be less robust than government-sponsored currencies. You should never invest funds that you are not willing to lose. However, investing in cryptocurrency is quickly becoming a mainstream activity and the companies that offer their services are based on the trust of their customers. Because of this, it is much safer than it was even a few years ago and may prove to be a lucrative opportunity for investors who are willing to invest over a multi-year time horizon.

Feel free to reach out with any questions. I'm a firm believer in the underlying technology that powers these currencies and am excited to be a part of a wealth creation opportunity like this.