What I Use Ethereum For

I recently watched a screening of the premiere for Vitalik: An Ethereum Story in Rome. The film follows the career of Ethereum's founder, Vitalik, through his early life and into the present day. It's a great introduction for anyone who wants to understand the people and stories behind the technology.

I've now been working in the Ethereum ecosystem for 8 years. Like many others, I was initially allured by the promise of a system that wasn't rigged against me. Since then, I've lived through several major speculative bubbles and subsequent crashes. And for the past three years I've received the majority of my salary in cryptocurrency paid directly to my wallet in the form of Ether or stablecoins like USDC.

This feels like a special moment for crypto. The pain of the last crash has mostly faded and the get-rich-quick types have left (or moved to on AI). The industry is beginning to consolidate its position in D.C. with much-needed advocacy groups like Stand With Crypto. Most importantly, the technology continues to improve.

Ethereum successfully completed the Merge, reducing its carbon footprint and increasing its economic security. L2s have finally given us sub-1 cent transaction fees, enabling a new class of emerging business models. And consumer applications like Farcaster and Polymarket are beginning to show signs of mainstream adoption.

With this in mind, I thought it would be helpful to document what I use Ethereum for everyday.

Entertainment

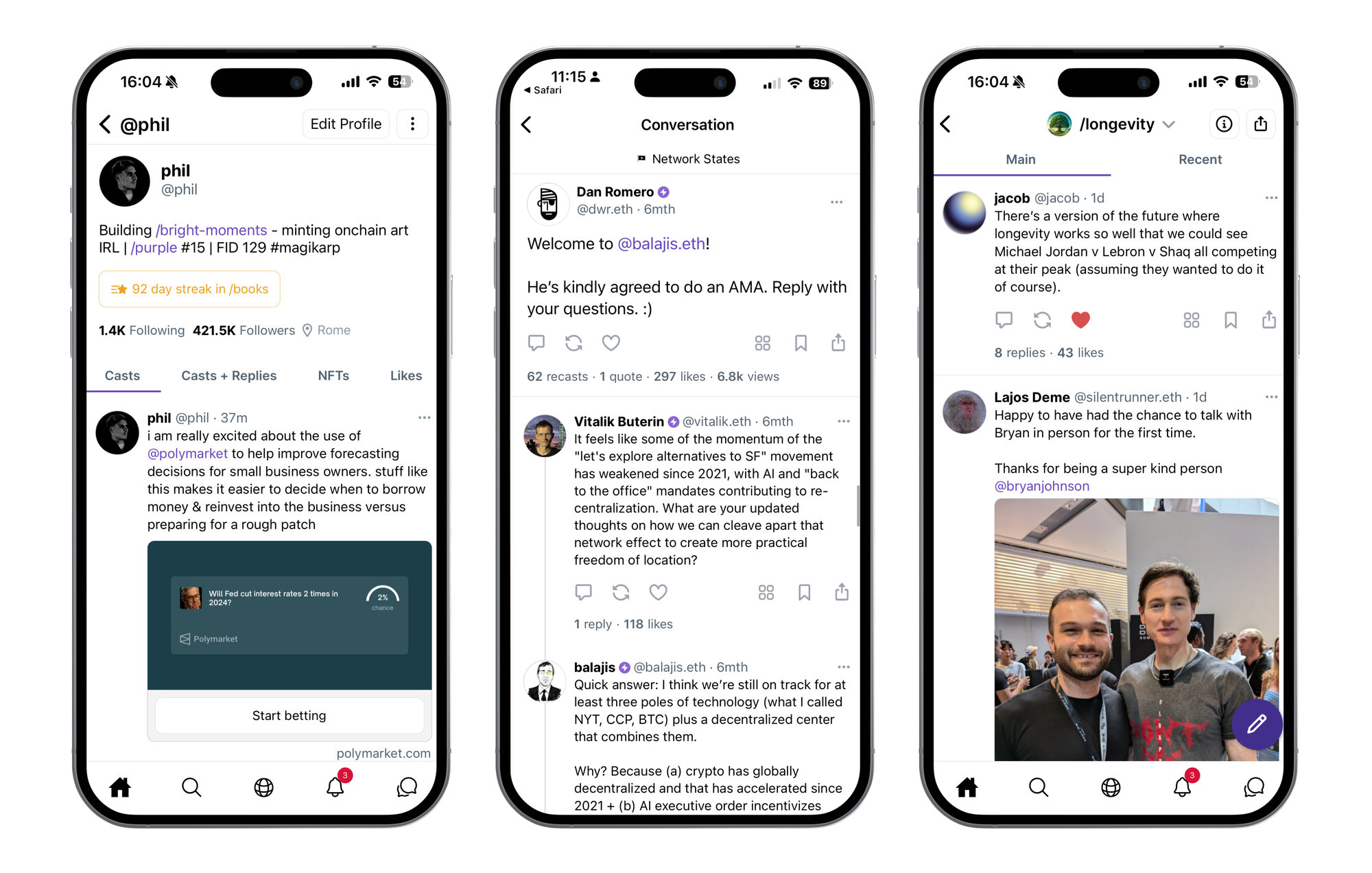

Farcaster is now my main social media platform. It works like Twitter, except the data is publicly available and every user has a cryptocurrency wallet embedded into their profile. These two simple changes open up a range of possibilities for the types of experiences that can be built. The beauty of Farcaster is the ability to take actions directly in the feed, like buying a subscription, purchasing media, or sending money to a friend. Having all of this functionality in one app and tied to a single source of identity is quite powerful.

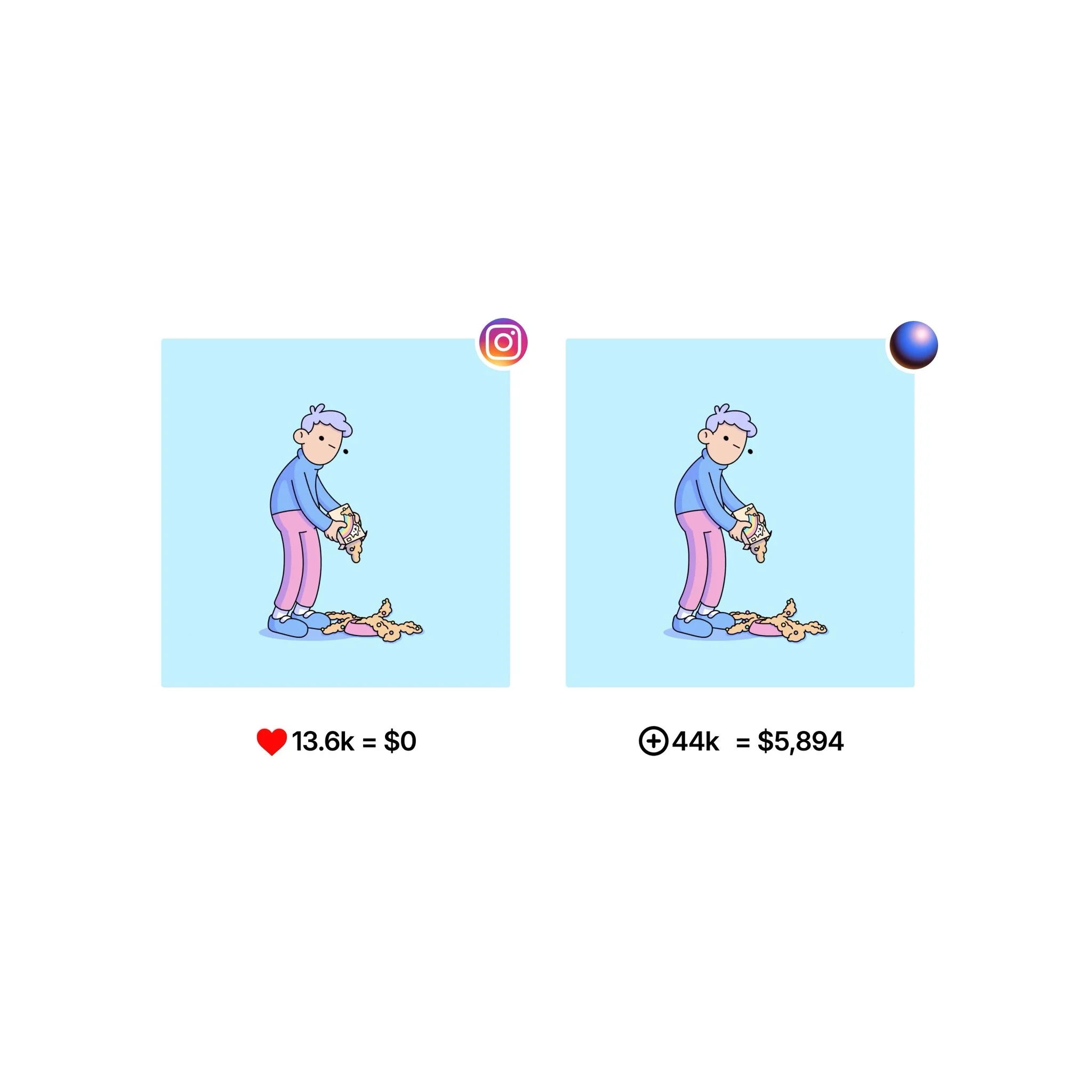

In addition to social media, I also use Ethereum to create and browse artwork on platforms like Zora. Zora uses an Instagram style feed to allow anyone to mint and browse onchain media. Unlike Instagram, where creators need to monetize through paid ads or off-platform products, creators are paid directly in Ethereum when someone mints their post.

These platforms have replaced much of my usage of legacy social media like Instagram, Twitter, and LinkedIn and are sources of daily inspiration, entertainment, and income.

News

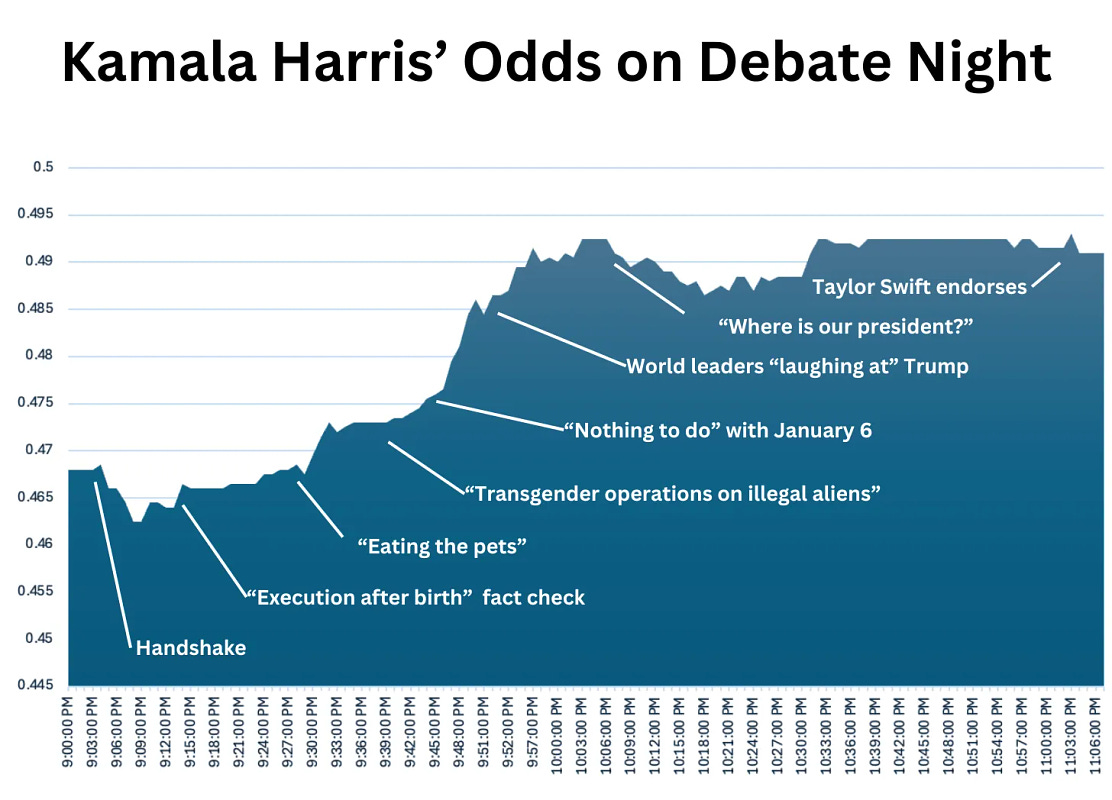

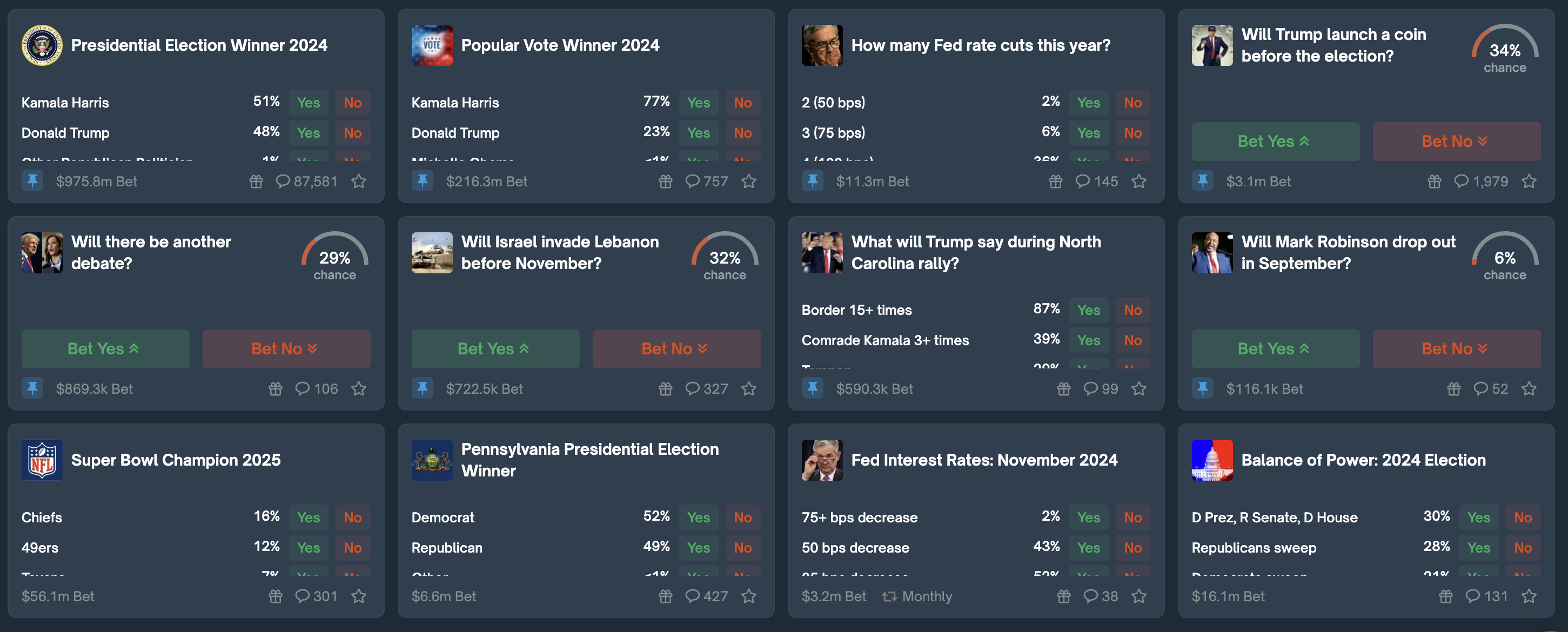

In addition to replacing existing categories, Ethereum has invented a few new ones. I have found myself visiting prediction markets like Polymarket frequently to gain perspective on global events.

Prediction markets allow anyone to bet on the outcome of an event. Since there is real money at stake, these markets update in real-time to incorporate breaking news and current events. For example, here are Kamala Harris' odds of winning the upcoming election on a per-minute basis during her recent debate with the former President.

Political outcomes are the main attraction for prediction markets (the 2024 U.S. presidential market has almost $1B in trading volume), but other markets are beginning to emerge for finance, global conflicts, and memes.

Polymarket is the dominant platform in this space, but other ideas are beginning to emerge, like tmr.news which allows you to place a bet on the next day's New York Times headline and earn money if your guess is accurate. Prediction markets are a fantastic way to calibrate your intuition about the probability of an uncertain event instead of relying on potentially biased media.

Banking

I hold a portion of my assets onchain in platforms like Aave, Lido, and Rocket Pool that generate yield and provide a passive income stream. These services play a similar role to traditional savings or money market accounts, but without the fees associated with traditional brokerages.

Lido, a liquid staking platform, currently offers a 3.1% APR. Crucially, this interest is paid out in Ether. That means you receive a fixed dividend in a deflationary asset. This simple formula has tremendous compounding potential and is an excellent alternative to long-term liquid savings accounts if you can ignore short-term volatility.

In addition to storage, I use Ethereum to transact daily through minting and micropayments. Much of this activity happens through the social networks I am active on, but an increasing number of international vendors and knowledge workers are willing and eager to accept cryptocurrency as an alternative to USD. The fees are cheaper and the access to funds is less complicated, especially in countries with high inflation like Argentina.

Conclusion

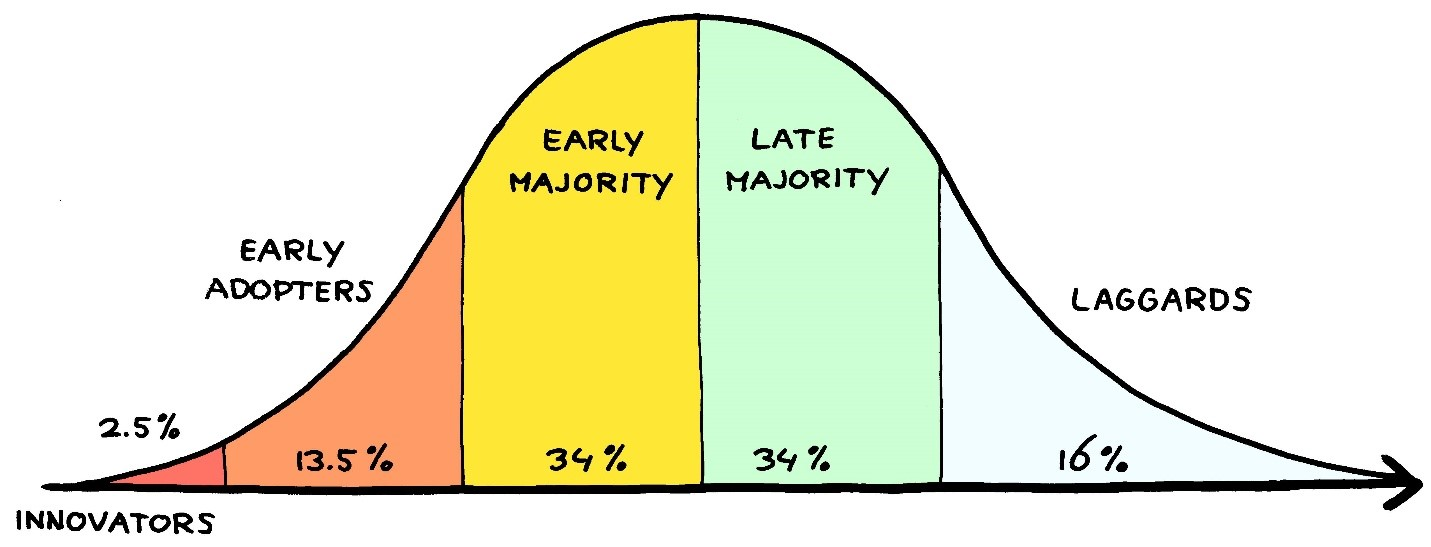

I'm an early adopter by nature. I like to try products and services when they are new and fresh and I can have an influence on their trajectory.

There is a shift underway. Ethereum is moving from people like me into the early majority. And while I'm excited to welcome more people to my world, I'll miss the raw sense of adventure that has dominated for the last decade. But the Wild West can't last forever; even cowboys need to hang up their boots.